Fha mobile home loan calculator

FHA might be just what you need. Ask an FHA lender to tell you more about FHA loan products.

Fha Loan Calculator Credit Karma

FHA loan limit - FHA home loans have maximum mortgage limits that vary by state and county.

. Your credit score is a number that represents a snapshot of your credit history that lenders use to help determine how likely you are to repay a loan in the future. Homeowner Tax Deductions. FHA mortgage insurance protects lenders against losses.

FHA loans have typically been known as loans for first-time homebuyers filled with extra paperwork and complexity since its a government-insured program. You can contact us at 757-296-2148 to get all your FHA loan questions answered. Simply enter your monthly income expenses and expected interest rate to get your estimate.

But the FHA loan program allows for credit scores of. Historically it has been 3. For today Monday September 19 2022 the national average 30-year FHA mortgage APR is 6460 up compared to last weeks of 6180.

Check out our affordability calculator and look for homebuyer grants in your area. An FHA insured loan is a US Federal Housing Administration mortgage insurance backed mortgage loan that is provided by an FHA-approved lender. Buying your first home.

Contact a HUD-approved housing counselor or call 800 569-4287. For example the minimum require score for conventional loans is 620. FHA property requirements - FHA loans require that the home being purchased meets certain conditions and is appraised by an FHA-approved appraiser.

Todays national FHA mortgage rate trends. You can only get a new FHA loan if the home you consider will be your primary residence which means that it cant be an investment property or second home. Mortgage limits are calculated based on the median house prices in accordance with HUD 40001.

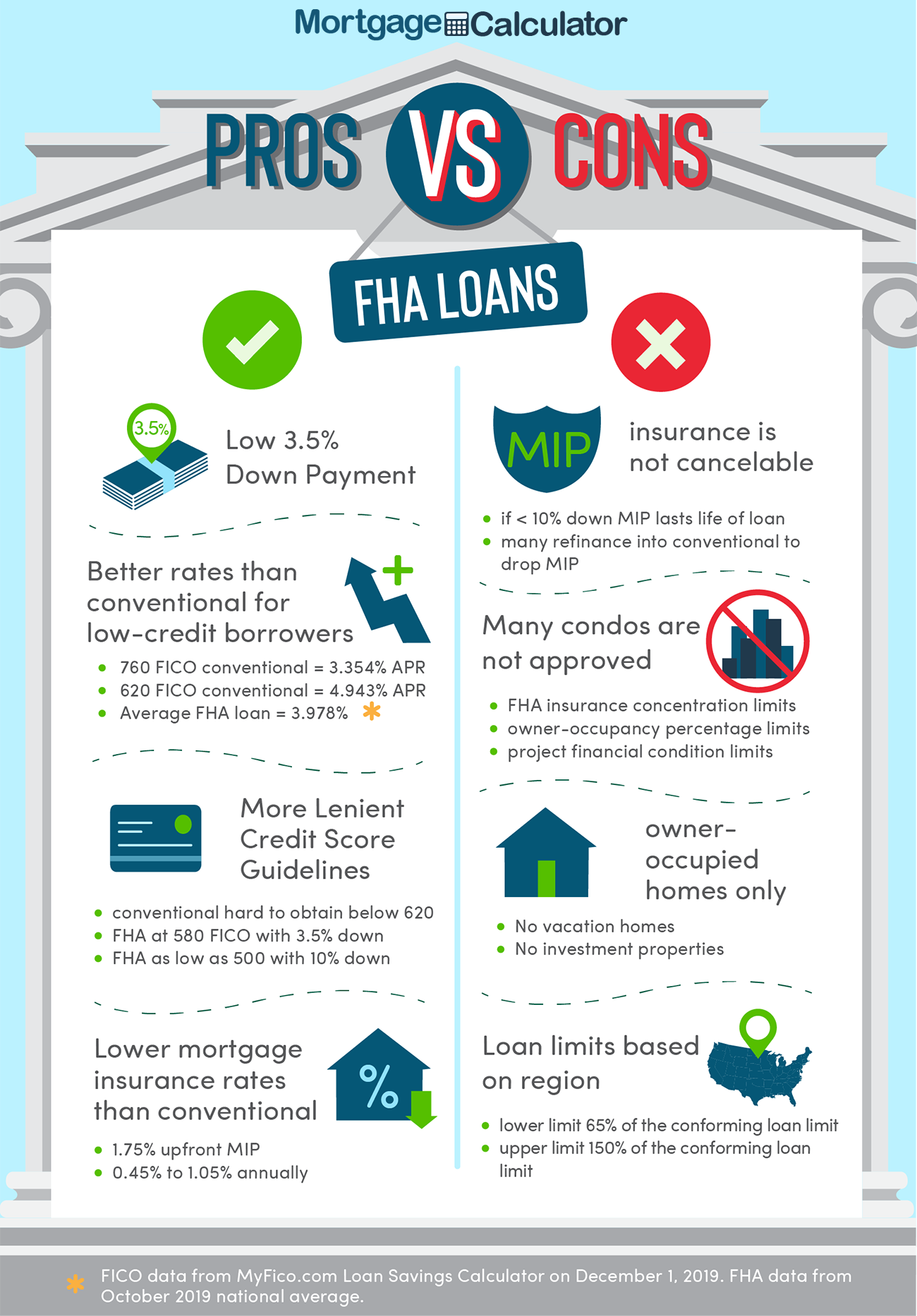

How FHA Loan Limits Work. Use this FHA mortgage calculator to get an estimate. FHA loans have lower credit and down payment requirements for qualified homebuyers.

A debt-to-income ratio is the percentage of gross monthly income that goes toward paying debts and is used by lenders to measure your ability to manage monthly payments and repay the money borrowed. They have historically allowed lower-income Americans to borrow money to purchase a home that they would not otherwise be able to afford. There are certain requirements borrowers must meet to qualify for an FHA loan including.

FHA down payment - FHA loan guidelines require a minimum down payment of 35 percent. The higher the credit score the better a borrower looks to potential lenders. FHA LOAN MAXIMUMS FOR MOBILE HOMES MOBILE HOME LOTS AND HOME-AND-LOT.

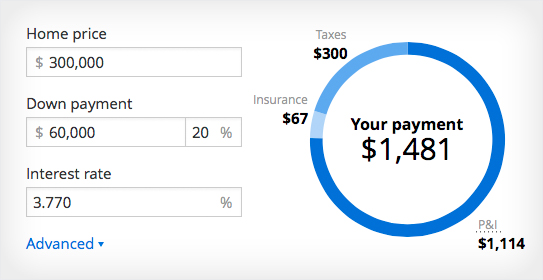

Use our fha loan calculator to help you estimate the costs and your monthly payment. Maximum loan for home plus land. The home you consider must be appraised by an FHA-approved appraiser.

Currently FHA mandates a minimum 35 down payment towards your house. Find an FHA lender. The mortgages are aggregated and sold to a group of individuals a government agency or investment bank that securitizes or packages the loans together into a security that investors can buyBonds securitizing mortgages are usually.

Once you find the price you can afford contact a Home Lending Advisor or go to your local branch to get started. In a typical scoring model your score generally ranges from a low of 300 to a high of 850. The maximum term is 15 years for a lot-only purchase.

FHA loan requirements and qualifications. Among other qualification requirements mortgages will have credit score requirements. For borrowers interested in buying a home with an FHA loan with the low down payment amount of 35 applicants must have a minimum FICO score of 580 to qualify.

Learn about the amount required to secure a home with an FHA loan. Minimum down payment is 35. Use our free mortgage calculator to estimate your monthly mortgage payments.

Choose the purpose of refinance for your manufactured home. However having a credit score thats lower than 580 doesnt necessarily exclude you from FHA loan eligibility. The FHA One-Time Close Loan is a secure government-backed mortgage program available for one-unit stick-built primary residences new manufactured housing for primary residences excludes single wide mobile homes and modular homes.

What is a debt-to-income ratio. July 30 2022 - FHA loan limits increased this year for many counties in the United States. You must occupy the property within.

It may not always seem clear whether to apply for a FHA loan or conventional loan. Determine what type of mobile home you own. You should lookup county-level FHA loan limits for your State and enter the home value accordingly.

The terms of an FHA loan for mobile homes include a fixed interest rate for the entire 20-year term of the loan in most cases. But borrowers can use multiple FHA loans for purchasing or refinancing a home loan. Visit our mortgage education center for helpful tips and information.

There are two kinds of DTI ratios front-end and back-end which are typically shown as a percentage like 3643. Shop for the best manufactured loan rates and terms. And from applying for a loan to managing your mortgage Chase MyHome has you covered.

Because this type of loan. Your down payment can be as low as 35 of the purchase price. FHA Title 1 loans for mobile homes.

Located in mobile home parks. And when youre ready to apply for a home loan you can start your loan application online. The bottom line is that if you want to own a home a manufactured one might be the way to go.

Adjust the loan terms to see your estimated home price loan amount down payment and monthly payment change as well. The FHA program requires a credit score of 580 or higher and allows loan terms of up to 20-25 years for mobilemanufactured homes. You just need to have a minimum down payment.

Learn more about fha loan down payments. Minimum FHA Credit Score Requirement Falls 60 Points October 11 2018. Chases website andor mobile terms privacy and security policies dont apply to the site or app youre about to visit.

The minimum credit score youll need depends on the loan type. FHA requires one-time UFMIP and. That term can be extended up to 25 years for a loan for a multi-section mobile home and lot.

FHAs single family mortgage limits are set by Metropolitan Statistical Area and county and are published periodically. Our affordable lending options including FHA loans and VA loans help make homeownership possible. The term mobile home is often used interchangeably with manufactured home.

Account for interest rates and break down payments in an easy to use amortization schedule. And we understand that you probably have questions about your unique situation and need assistance navigating your home loan options. Even if you have low credit there are still options for buying a home.

Fannie Mae HomePath. An FHA loan is a government-backed conforming loan insured by the Federal Housing Administration. Choose the right loan program for your mobile home refinance.

Your Guide To 2015 US. A quick look at the features of an FHA Manufactured Home Loan. For instance the minimum required down payment for an FHA loan is only 35 of the purchase price.

To get an FHA loan find a bank credit union or mortgage lender who works with FHA-loans. A mortgage-backed security MBS is a type of asset-backed security an instrument which is secured by a mortgage or collection of mortgages. Term is typically 20 years.

FHA Loan limits vary nationwide for single-family two-family three-family and four-family properties.

Usda Loan Payment Calculator Calculate Loan Guarantee Eligibility Closing Costs How Much You Can Afford To Borrow

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

Kentucky Manufactured Home Loans For Doublewide Mobile Homes For Fha Va Usda Khc And Fannie Mae Home Loans Mortgage Loans Buying First Home

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

Facts About Fha Manufactured Homes Loans

Can I Get An Fha Loan For A Mobile Home

1 Manufactured Home Loan Calculator How Much Can You Afford Manufactured Nationwide Home Loans 1 Manufactured Home Loan Lender In All 50 States

1 Manufactured Home Loan Calculator How Much Can You Afford Manufactured Nationwide Home Loans 1 Manufactured Home Loan Lender In All 50 States

Manufactured Housing Co Branded Manufactured Home Accomplishment Manufacturing

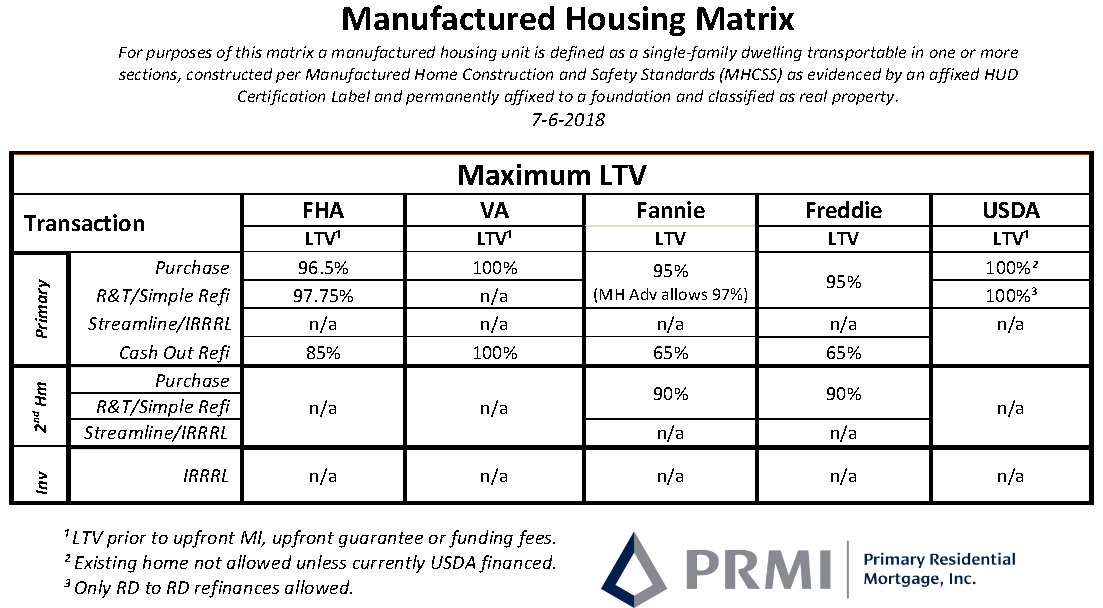

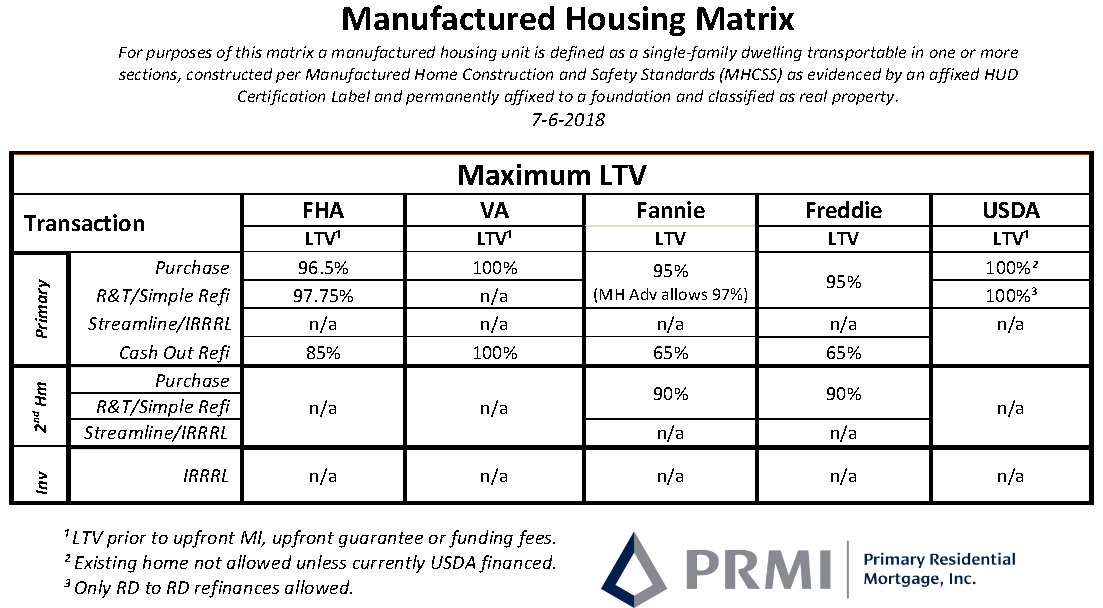

Delaware Manufactured Home Loans Prmi Delaware

Va Mortgage Calculator Calculate Va Loan Payments

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

Kentucky Manufactured Home Loans For Doublewide Mobile Homes For Fha Va Usda Khc And Fannie Mae Home Loans Manufactured Home Fannie Mae

Fha Rules For Manufactured Modular Homes

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

Usda Home Loan Qualification Calculator Freeandclear